[ad_1]

Some graduate applications go away college students worse off financially, a brand new report analyzing college students’ debt and earnings discovered.

The HEA Group, a analysis and consulting company targeted on faculty entry and success, partnered with the Nationwide Pupil Protection Authorized Community to research graduate pupil debt and whether or not applications throughout the USA enable college students to repay their loans.

“With no checks and balances in place, this cycle the place college students tackle large quantities of debt—that they may by no means have the ability to totally pay again—will proceed to happen,” says the report, launched immediately.

At practically one-third of the 1,661 establishments included within the evaluation of Training Division knowledge, college students in a two-year cohort collectively owed extra 5 years after coming into reimbursement than they initially borrowed. At 24 establishments, a two-year cohort of scholars has accrued greater than $25 million in curiosity, in response to the report.

The report additionally included debt-to-earnings ratios for greater than 6,300 applications throughout the establishments. To obtain the underlying knowledge units, go to the report’s web site.

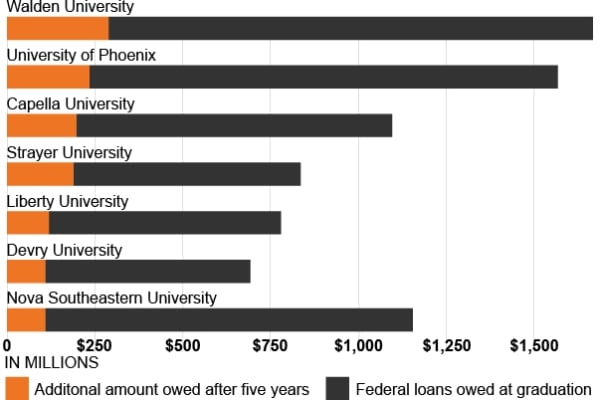

Walden College, a Minnesota-based for-profit establishment with greater than 40,000 graduate college students in fall 2021, topped the record of establishments the place college students owed extra collectively than what they borrowed. Walden’s graduate college students who borrowed in 2013–14 and 2014–15 owed $289 million extra in loans 5 years after coming into reimbursement, in response to the report. The College of Phoenix ranked second; its graduate college students’ balances had elevated by $235 million. Among the many high 24 establishments, 11 are non-public nonprofit, 9 are for-profit and 4 are public. The report didn’t break down the debt owed on a per-student foundation.

“It paints an image of the place college students are 5 years after they go away graduate college at an establishment of upper schooling,” stated MichaelItzkowitz, founding father of the HEA Group and the report’s writer. “A few of it raises trigger for concern as we will see college students owing a whole lot of hundreds of thousands of {dollars} greater than the quantity that they initially borrowed. Which means their pursuit of a greater future could also be delayed at greatest, and it could go away them worse off at most.”

Graduate college students make up a few quarter of the nation’s pupil mortgage debtors and maintain about half of the nation’s complete federal pupil mortgage quantity. Coverage makers and advocates have change into more and more involved in regards to the ballooning balances of those college students and the outcomes of graduate college applications. The Training Division not too long ago up to date its public-facing Faculty Scorecard to, for the primary time, embrace program-level knowledge about graduate colleges, which Itzkowitz used within the evaluation.

Chazz Robinson, a coverage adviser for Third Approach, a center-left assume tank, stated graduate applications and college students have been forgotten about in federal coverage discussions.

“Numerous that is as a result of minimal knowledge that’s supplied on graduate schooling as an entire however with the division’s additions to the Faculty Scorecard hopefully this improves over time,” he wrote in an e mail. “There’s been a long-standing perception that when a pupil attends graduate college they’re routinely blessed with higher outcomes and earnings potential, however this report is highlighting that’s not all the time the case.”

Robinson added that the report highlights that graduate applications shouldn’t be exempt from accountability.

“There’s a transparent case of scholars taking up massive money owed for applications that aren’t paying off,” he wrote. “If we wish higher outcomes for college students, we have to study increased schooling in its entirety and that features graduate schooling.”

Itzkowitz stated the report offers one piece of a much bigger image.

“I believe it offers alternatives for colleges to assist study the kind of schooling they’re providing, the associated fee that they’re providing it at and the kind of outcomes that they’re having after college students receive their graduate credential,” he stated. “In that sense, this knowledge is a chance for establishments, which they need to use in the event that they’re taken with bettering the outcomes of their college students who enroll in graduate college.”

Walden College didn’t reply to a request for remark in regards to the report’s findings.

The info evaluation included pupil debt and earnings for the two-year cohort of graduate college students at 1,661 establishments and 6,371 graduate applications. On the establishment degree, Itzkowitz multiplied the department-provided reimbursement charge by the quantity of federal loans owed to get the entire quantity of loans remaining 5 years later. For every particular person graduate program, the evaluation supplied a debt-to-income ratio utilizing median debt and median earnings knowledge 4 years after college students accomplished this system.

For instance, college students in Walden’s doctorate in psychology owe 243 % extra in pupil loans in comparison with their earnings 4 years after finishing this system, in response to the evaluation.

“These are type of items of the puzzle by way of graduate pupil mortgage efficiency that we’re restricted to these days,” Itzkowitz stated. “We will get higher knowledge and we should always get higher knowledge to assist us consider how properly a majority of these applications are literally serving college students. Even with some such poor outcomes, we now have very minimal if virtually no legal guidelines in existence to carry these applications accountable for the outcomes of their college students.”

The graduate applications at for-profit establishments in addition to non-degree-granting graduate applications at different establishments can be topic to the division’s proposed gainful-employment rule that’s anticipated to be finalized later this 12 months.

The Council of Graduate Colleges desires to see plenty of adjustments to federal pupil loans that it says would make the system extra accessible to graduate college students. These adjustments embrace increasing Pell Grant eligibility from 12 to 18 semesters, which might enable college students to place the funds towards a graduate or skilled diploma.

Julia Kent, vice chairman for greatest practices and strategic initiatives on the Council of Graduate Colleges, stated the council additionally helps reinstating backed direct loans for graduate college students, which don’t accrue curiosity whereas the coed is in class.

“That basically saves college students who’re attempting to spend money on their futures 1000’s of {dollars},” she stated, commenting on the difficulty of graduate pupil debt extra broadly as a result of she hadn’t seen the report or the underlying knowledge but.

She stated that mortgage counseling and monetary assist schooling ought to be required for college students coming into a graduate diploma program. Kent added that it’s vital for establishments to be clear about their graduates’ profession outcomes in order that college students could make knowledgeable choices when contemplating a program.

“Graduate college students ought to actually perceive their choices once they’re contemplating investing in a graduate diploma,” she stated. “There’s an enormous payoff by way of earnings and diminished unemployment for holders of graduate levels, so we have to discover methods as a rustic to assist these investments for college students and be certain that they’re not penalized for attempting to advance of their careers.”

[ad_2]