[ad_1]

When you’re a mother or father planning to your baby’s future schooling, the price of school could be overwhelming. Primarily based on at the moment’s charges and assuming a 5% annual price enhance, the whole price of attendance of 4 years at a public, four-year faculty could possibly be almost $200,000 inside the subsequent 10 years.

However why is school so costly? Many elements are accountable for driving costs up, from decreased state funding to greater demand for high-end campus facilities. Nonetheless, there are methods to decrease schooling prices and make school extra reasonably priced.

The Value of Faculty Has Steadily Elevated Little by Little Every Yr

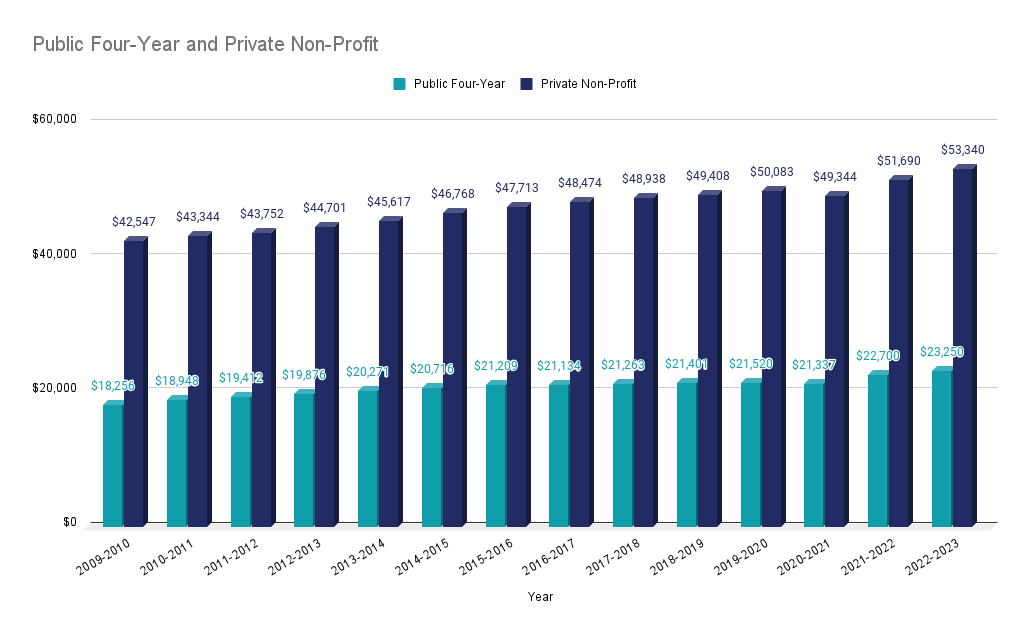

The price of school has elevated steadily over the previous couple many years. In the course of the 2009-2010 educational yr, the typical price of tuition, charges and room and board was $18,256 at a public four-year faculty. For the 2022-2023 educational yr, that price was $23,250 — a 27% enhance.

Personal colleges noticed comparable value will increase. The typical price in 2009-2010 for a personal non-profit college was $42,547. For the 2022-2023 educational yr, the price elevated by 25% to $53,340, which is about the identical progress charge seen in public colleges.

These will increase are the results of small, incremental will increase annually to account for inflation, new facilities for college kids, and up to date amenities to supply one of the best expertise attainable for every scholar. We checked out the entire the reason why school has grow to be costly over time.

Causes Why Faculty is Costly

Why are faculties so costly today? There’s no single issue driving the rising costs. As a substitute, the worth will increase are as a consequence of a number of contributing elements.

1. Inflation charges are excessive

Over the previous two years, inflation has been a serious concern. Inflation was over 9% in June 2022 and is now at about 5% — nonetheless above the federal government’s goal charge.

Excessive inflation makes all the things costlier. Colleges have substantial overhead prices, together with constructing upkeep, provides, landscaping, and meals. Their common bills are greater because of inflation, and so they go a few of that price onto college students via greater tuition and costs.

2. Faculties spend extra on promoting and recruitment

After many years of progress, the variety of college students going to varsity slowed lately. The truth is, Inside Greater Ed reported that school enrollment numbers have fallen for 5 semesters in a row.

Declining enrollment means colleges should compete for incoming college students greater than ever. Consequently, they’re spending a major amount of cash on promoting and recruitment efforts.

Collectively, faculties spend tens of millions annually on all the things from tv commercials to social media adverts and billboards. Colleges want to boost their tuition and costs to afford these promoting efforts.

3. Campus facilities are enhancing

To draw new college students, many colleges constructed state-of-the-art scholar recreation facilities and different facilities. Take into account these examples:

- College of Missouri: Mizzou’s Tiger Grotto contains a zero-entry pool, sizzling tub, sauna, steam room, and a lazy river.

- Excessive Level College: This campus has a wide range of high-end facilities, together with an indoor observe, a number of swimming pools (together with indoor ones), jacuzzies, ice rinks and eating facilities with choices from Subway, Chick-fil-A, and Starbucks.

- College of Wisconsin-Madison: At this faculty, college students can hang around on the Sett Recreation Middle. It options perks like an precise bowling alley, a mountain climbing wall, and pool tables.

These faculty perks aren’t that uncommon; extra faculties and universities are growing costly scholar facilities and dorms to attraction to new candidates and to make college students’ on-campus expertise comfy and gratifying. Consequently, the price of attendance is way greater.

4. Colleges obtain much less cash from states

Typically, states are spending much less on public faculties and universities than they did prior to now. The Nationwide Training Affiliation discovered that funding has declined by about $1,500 per scholar. To make up for the misplaced funding, colleges have elevated their tuition and costs, passing the price to households.

5. Federal monetary support has declined

Federal monetary support is among the most typical types of monetary help for faculty college students. Federal support can come within the type of federal scholar loans, Pell Grants, and veterans’ advantages.

Nonetheless, federal monetary support has considerably declined. In keeping with The Faculty Board, whole federal grant support declined by 32% in inflation-adjusted {dollars} between the 2011-2012 and the 2021-2022 educational years. Pell Grants, a federal grant issued to low-income college students, declined by 36%, lowering by $14.6 billion.

With much less federal support obtainable, faculties need to make up for a few of the shortfalls by providing their very own grants, scholarships and even institutional scholar loans — which add to the college’s bills.

7 Suggestions for The best way to Make Faculty Reasonably priced

How can I make school cheaper? It’s a typical query. With these seven ideas, you possibly can decrease your schooling prices:

1. Attend neighborhood school

Neighborhood faculties price considerably lower than four-year colleges. By attending a neighborhood school for the primary two years of college and transferring to a four-year faculty to complete your diploma, you possibly can slash the price of a bachelor’s diploma.

2. Select an in-state public faculty — or search for a reciprocal program

An in-state public faculty will price half what a personal faculty prices. Attending school inside the state the place you reside is one approach to cut back your bills.

However if you wish to attend faculty out-of-state, take into account a public college that’s a part of a reciprocal community. Many states take part in networks that enable college students to go to high school in one other state however pay in-state tuition charges.

Yow will discover out in case your state participates in a tuition alternate or reciprocity program by visiting the Nationwide Affiliation of Scholar Monetary Help Directors’ web site.

3. Submit the Free Utility for Federal Scholar Help (FAFSA)

Not solely does the FAFSA provide help to qualify for federal monetary support, however colleges, states and non-profit organizations typically use it to find out your eligibility for different support, together with grants and work-study packages.

Submit the FAFSA by the federal, state and college deadlines to get the utmost quantity of support attainable.

4. Analysis scholarships and grants

There are billions of {dollars} in grants and scholarships obtainable. They’re issued by non-profit organizations and personal corporations everywhere in the nation, and you may apply for a number of awards and mix them to scale back your school prices.

Discover scholarship alternatives by looking databases like FastWeb, Scholarships.com and The Faculty Board.

5. Take into account a part-time job or facet hustle

When you can comfortably deal with your school coursework, getting a part-time job or facet hustle can will let you earn cash to pay for a few of your bills, resembling your meals or textbooks.

Assets like SnagAJob and SideHustleNation may also help you discover jobs which can be appropriate for a school scholar’s schedule.

6. Commute to high school

Though residing within the dorms could be interesting, school room and board could be costly. The price of your dorm and a school meal plan can add $10,000 to $15,000 per yr to your price of attendance.

In case your dad and mom are keen to have you ever stay at house when you’re in class, it can save you a major amount of cash by commuting to high school. Even when you pay your dad and mom lease, residing at house could be less expensive than residing on campus.

7. Apply for personal scholar loans

In case your monetary support package deal isn’t sufficient to cowl the complete price of attendance, you should utilize personal scholar loans to pay for the remaining steadiness. As a school scholar, you might not meet the necessities for a personal mortgage since you don’t have a full-time job or established credit score historical past. However you possibly can enhance your probabilities of getting a mortgage — and qualifying for a aggressive rate of interest — by asking a mother or father, relative or good friend to cosign the mortgage.

Planning for faculty bills

Now that why school is so costly, you can begin developing with a plan to pay for varsity. Whereas school prices are greater than they had been prior to now, you may make the expense extra manageable by exploring your monetary support choices, selecting a public in-state faculty and making use of for grants and scholarships.

Be taught Extra: A Full Information to Scholarships for Faculty College students

[ad_2]