[ad_1]

Round Financial system is the true 4th industrial revolution. Decoupling financial development from useful resource consumption and creating sustainable enterprise satisfies shareholder, shopper, stakeholder, and enterprise wants alike. Looping as we speak’s linear Provide Chains disrupts how shopper wants are glad as we speak – from Provide Chain processes, group over to product design and ecosystem necessities.

Pushed by useful resource shortage, rising economies and the rise in inhabitants and wealth, the idea of a Round Financial system has emerged as a part of the answer for a transition in the direction of sustainability. Regardless of not being new, there are solely area of interest functions of the idea to current, but a hype anticipated within the close to future. Current developments such because the shift to a multipolar enterprise world or more and more disruptive occasions are fueling the transition.

Round Financial system: the true 4th industrial revolution?

It took Round Financial system nearly twenty years to incubate – nonetheless, it might change into the true 4th industrial revolution, demoting Business 4.0 to an enabler as an alternative of the predominant transformation issue.

4 key forces are globally accelerating our transition to sustainable companies and most of them are basic and irreversible:

1. Capital shifts in the direction of sustainable companies

2. Regulators push inexperienced, honest and resilient provide chains

3. Societal mindset & shopper habits are disrupted

4. Expertise permits new enterprise fashions and bodily

materials streams

Round Financial system is in some ways the reply to challenges arising from these radical paradigm shifts of traders, regulators, customers, and expertise. The true dilemma lies within the complexity of orchestrating the transition. Product design, materials flows, possession & enterprise fashions in addition to eco-systems want radical rethinking throughout extremely atomized & streamlined worth chain contributors. Any method beginning such a metamorphosis with a couple of specialists or from a single angle of the worth chain is doomed to both fail of fall quick on influence and outcomes.

Activation power problem

To beat the dilemma of missing each the clear start line and a easy transformation roadmap, we have to perceive the underlying success components for Round Financial system implementation:

• Trustful collaboration & open tradition

• Holistic mindset & idealism

• Broad know-how

Embedding Round Financial system into a corporation wants upfront set up of those foundational components, that contradict many points of how we’re doing enterprise as we speak. They are going to act as catalysts that make the transition in the direction of financial development decoupled from useful resource consumption potential. -The holistic nature of Round enterprise reinvention makes incremental approaches out of date as they’d not often be economically viable. Thus, trustful collaboration throughout worth chain contributors, holistic approaches and deep information of Round Financial system in all features and on all ranges of the organizations are important to success.

Loop the chains

Closing loops within the Technosphere and Biosphere is greater than a matter of rerouting transports.

The round financial system will substitute linear economies, creating extremely interconnected flows of products. Logistics will change into the middle of future enterprise fashions and shall be referred to as upon to reside as much as its duty. The demand for localized, condition- and cycle-specific transport options is rising, and new value-added providers will emerge.

Closing loops within the Technosphere and Biosphere is greater than a matter of rerouting transports.

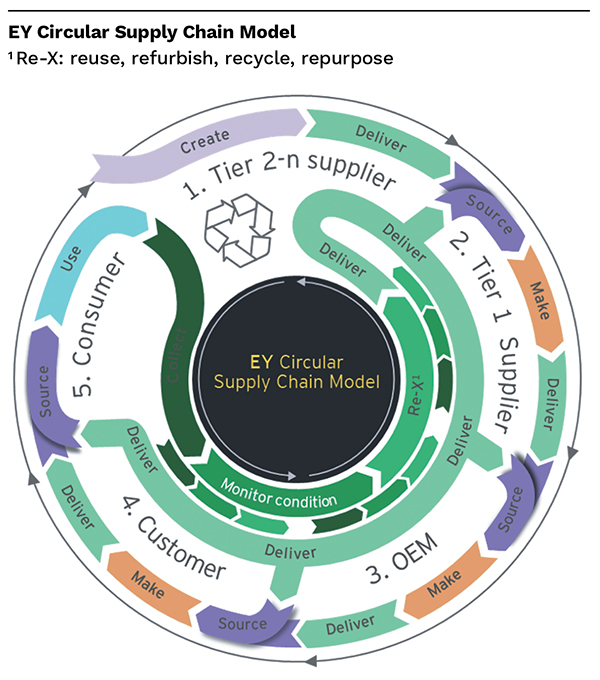

A brand new provide chain mannequin “Provide, Acquire, Overhaul & Re-X” exhibits which new course of steps equivalent to analyzing or monitoring components situation have to be built-in into future logistics. Manufacturing operations are blended with Re-X (reuse, refurbish, recycle, repurpose) and wish replicable, secure, and environment friendly operations in all main markets. This may require Business 4.0 expertise to compensate the lack of information within the localized operations. Additionally, the transactional aspect is not going to work and not using a important diploma of digitally enabled automation: information capturing and transmission should feed the operational & monetary processes in addition to and the person product data.

Rethink the whole lot

Closing the availability chain loop opens the door to long-term worth creation for stakeholders and the atmosphere. The benchmark ideas of Round Financial system create a constructive environmental, social and/or financial footprints as an alternative of simply lowering adverse results. Such options are extremely engaging to Customers, Buyers and even act as expertise attractor for the group itself. In addition to this relatively intangible worth, most Round Financial system enterprise circumstances are financially much more engaging than their linear counterparts – particularly when bearing in mind ever rising environmental price implied by regulators.

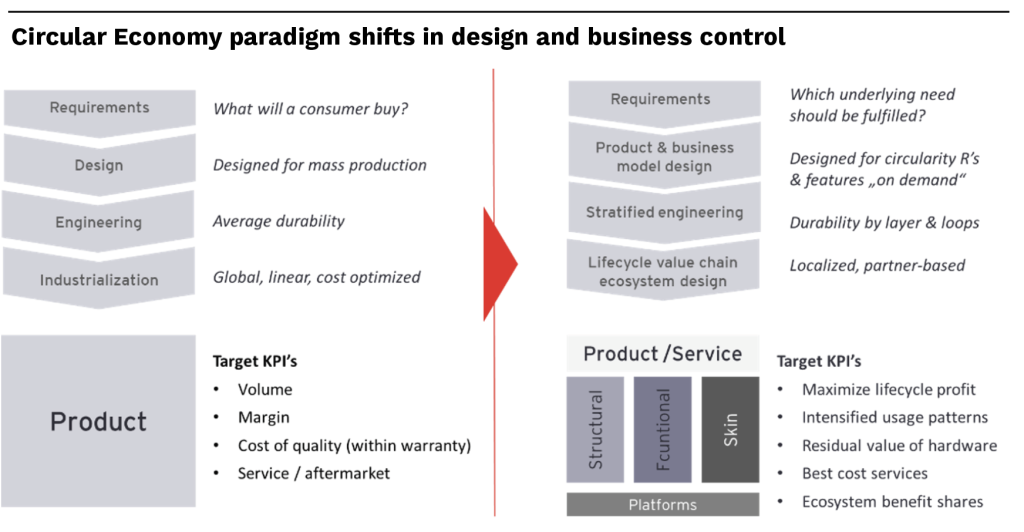

Round pondering calls for a shift in firm tradition, as the normal view of how a enterprise operates and makes cash is turned the wrong way up. Round fashions require a longer-term view and ample persistence – generally money stream won’t be realized till the second iteration of a product when sources lastly get reused. Considering a step additional, product design ideas will change based on the enterprise fashions utilized. For complicated shopper and industrial merchandise, this would come with a stratification of merchandise with completely different design standards for structural, useful and “pores and skin” components. In all circumstances, the built-in method to rethink design, enterprise mannequin and matching eco-systems is required.

For a round technique to work, all of the ecosystem companions – together with suppliers and manufacturing companions – should decide to the method. One of many greatest obstacles is bringing all of the contributors of a worth chain collectively and having them act as one firm. Typically, it’s a matter of “who goes first,” as every provider might really feel they’re within the fallacious place within the worth chain to launch the trouble.

Then there’s the added complexity of the availability chain. From begin to restart, a round provide chain is bigger and far more difficult than a conventional linear mannequin. Designs should account for sturdiness and consistency to maintain parts in play longer and for ease of disassembly to effectively reuse sources. Monitoring all of the components of a product and their histories is critical to find out which components have to be changed and when. Reverse logistics are an added hyperlink within the chain to verify components get returned to the unique producer for recycling or reuse.

Bye bye, conventional Provide Chain features

Going round will result in disruptive adjustments in conventional provide chain features. Your entire mannequin and setup of how product lifecycles are dealt with might change considerably to service-oriented approaches. The important thing components for financial success shall be pushed by product design, ecosystem setup and digitally oriented service excellence relatively than worth, inventories, or conversion price.

Going round will result in disruptive adjustments in conventional provide chain features. Your entire mannequin and setup of how product lifecycles are dealt with might change considerably to service-oriented approaches.

PROCUREMENT: as we speak’s commonplace provide chain setup, a number of the basic adjustments may be anticipated clearly. The procurement operate should change into the orchestrator of ecosystems that present providers through the product lifecycle. Transparency and digital integration primarily based on product lifecycle administration (PLM) data accessible to all contributors within the materials loops is a key facet. Different possession fashions will scale back the classical strategic and operational procurement actions to a naked minimal. As an alternative, future consumers might want to repeatedly assess the valuation of parts, components and materials transitioning through the technosphere and biosphere loops. Shopping for providers and creating service suppliers might change into one of many key points of round procurement.

PLANNING: For planning features, balancing demand, provide of supplies and manufacturing capability will change into easy issues from the previous. Within the round future, materials provide shall be new supplies to a small extent and normally, used components that require particular person processing earlier than coming into the following lifecycle loop. Manufacturing capability shall be divided into restore, refurbish, reuse and recycle, every in want of ‘manufacturing’ planning primarily based on the situation of the returned items. Forecasting might shift from easy product gross sales in the direction of understanding the utilization depth in PAS (product as a service) fashions. Demand peaks may be fulfilled in a number of methods in shared asset enterprise fashions, availability of the product is relying on the variety of belongings, their uptime, native demand and different components. Round planning would be the key to figuring out the economically appropriate timing for alternative or restore of belongings according to present demand patterns.

LOGISTICS will shift from in- and outbound transport of products in the direction of complicated distribution and relocation of belongings based on demand. Enterprise fashions could also be enriched by differentiated reverse logistics and have to be synced to technosphere providers equivalent to restore, refurbish or disassembly operations. Logistic suppliers might even embody on-site providers equivalent to changing parts, easy upkeep or cleansing of their portfolio. Future logistical processes might contain assessing asset circumstances to find out the following processing step (from easy re-use to refurbishment, disassembly or recycling).

MANUFACTURING presently faces challenges involving the complexity of product variants and rising customization. Business 4.0 helps the pattern in the direction of lot measurement one and could also be key for round financial system manufacturing as effectively: the extra complexity comes from various circumstances of components and parts coming back from a use cycle. Expertise will as soon as once more allow the lot measurement one pattern in materials provide. Nevertheless, the transformation is not going to kick in easily, as many merchandise want radical redesign for maintainability, repairability and disassembly earlier than they’re appropriate for round enterprise fashions.

The timing to embark on the transformation journey couldn’t be higher. The regulatory atmosphere has been created is about to be created in nearly all areas worldwide, monetary traders are in search of alternatives with long-term worth and public opinion is more and more in favor of sustainable companies and choices. Most significantly, digitalization has reached the required maturity degree to allow financial viability for round financial system enterprise fashions even for complicated technical merchandise. Ranging from platforms, location expertise and automatic ordering and billing processes that assist a sharing financial system to stylish I4.0 expertise that helps automate particular person processes each in meeting and repair operations. Blockchain expertise helps digital chains that create transparency for technical circumstances and possession transactions for product or parts that run by a number of lifecycles within the technosphere loop.

The challenges for closing the loops and switching to a Round Financial system are primarily:

• Redesigning merchandise and making them appropriate for prolonged lifetimes and industrialized disassembly processes

• Switching enterprise fashions and organizing financing fashions for brand spanking new materials possession constructions

• Creating ecosystems serving the loops primarily based on honest worth contribution sharing ideas to draw the fitting companions

The transformation may be summarized because the journey from linear, world Provide Chains in the direction of regionalized, round ecosystems, absolutely leveraging expertise and automation. Profitable round companies have boosted margins, modified their adverse footprint to constructive in a number of areas of sustainability and usually contributed on to decarbonization. In these circumstances, Provide Chains modified dramatically, together with the portfolio of suppliers, key worth drivers and geographical extent, in lots of circumstances even impacting buyer conduct. Decoupling financial development from useful resource consumption: the following industrial revolution?

Re-Metering – a case examine

A producer of stream metering units confronted a cloth worth enhance for his or her core mechanical parts some years in the past. Most opponents reacted by switching to plastic primarily based parts with greater put on, but higher price positions. The producer took the strategic resolution as an alternative, to use Round Financial system ideas, leading to a product redesign with even greater high quality and costlier parts. The stream meters are usually bought to municipal utilities they usually have to be changed after the calibration interval, thus location and return timing of those merchandise is clear. Utilizing a modest incentive to activate technicians to return the changed units yielded a 40% return charge. Refurbishment price together with the motivation and logistics efforts had been nonetheless a fraction of virgin gear manufacturing. Regardless of a adverse margin within the first cycle, the producer was capable of understand a 250% margin enhance in comparison with the outdated linear product when averaging cycle 1 and a pair of. Given the potential enhance in return charges (e.g. by switching to lease/rental enterprise fashions) and contemplating deliberate regulatory adjustments that may enable units to be immediately reused if recalibration is profitable, there’s a important worth creation upside for the longer term.

This text was initially printed on 2 July 2022.

In regards to the Writer

[ad_2]