[ad_1]

31 Might The Advantages of Guarantor Loans

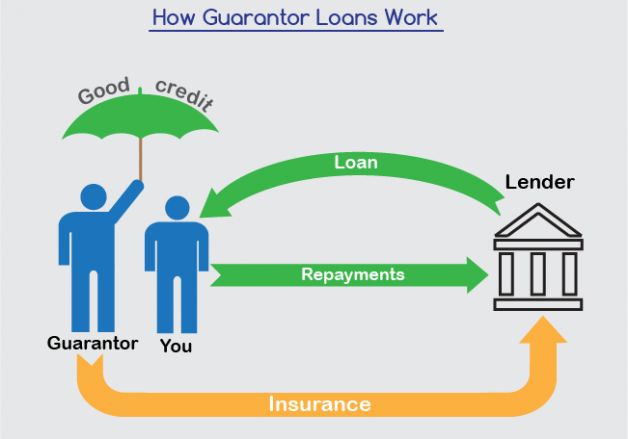

When you’ve got no credit score historical past and may’t get permitted for conventional loans, guarantor loans are an possibility to think about. Want cash and have somebody who will put up their very own credit standing as collateral? You are actually in Guarantor Mortgage nation. Listed here are a number of the advantages of Guarantor Loans so you possibly can determine if they’re best for you or not.

What’s a Guarantor Mortgage?

A guarantor mortgage is a sort of private mortgage that’s secured by a 3rd occasion. It’s them who’re answerable for reimbursement in case you default. The benefit is {that a} good credit score historical past will be helpful in getting higher rates of interest. Guarantor Loans will be harder to acquire if the non-guarantor has a very bad credit historical past. Earlier than taking out certainly one of these loans, it’s smart to know each their execs and cons. One of many main drawbacks which is price contemplating from the outset is what occurs if issues go fallacious and you’ll’t pay? Is your relationship along with your guarantor robust sufficient to resist monetary shocks?

What do you get with a Guarantor Mortgage?

You get a Guarantor Mortgage from a industrial lender similar to a financial institution, credit score union or different monetary establishment. Your lender will conduct an investigation into your credit score historical past. This can decide whether or not you’re a appropriate candidate for his or her mortgage product. In case your software is permitted, then they could request that somebody assure your mortgage by signing on to be obligated to repay it in case you fail to take action. Normally an individual who has a superb credit score historical past can act as a guarantor with none points. Nevertheless, there are some limitations as effectively. For instance, what occurs in case you lose your job and may not afford your funds? This could possibly be problematic as a result of it could replicate poorly in your sponsor’s credit score historical past – inflicting them problem in gaining future loans.

The place are you able to apply for one?

You’ll be able to apply for a Guarantor Mortgage via Badger Loans. Badger offers loans to most prospects, no matter whether or not or not they’ve been rejected by different lenders. Now we have lately teamed up with 1Plus1 Loans Ltd who’re a direct lender of Guarantor Loans. Merely go to our Guarantor Mortgage web page, learn up on as a lot information as you are feeling you could make a balanced choice, then hit the Apply Now button. You’ll be taken straight via to 1Plus1’s software web page the place you may get the ball rolling.

Extra Professionals than Cons?

When you’ve got unhealthy or no credit score, there’s a superb probability that you just haven’t had many decisions by way of credit score choices. However, you probably have somebody with a stellar monetary historical past prepared to again your mortgage, you might be eligible for a guarantor mortgage. Listed here are some extra execs to guarantor loans. You don’t want good credit score. It may be exhausting to discover a lender who will work with you you probably have very bad credit. It’s because lenders need to defend themselves from getting caught paying off unhealthy money owed. With guarantor loans, nevertheless, issues change so long as you’ve gotten somebody prepared to vouch to your capacity to pay them again (i.e., your guarantor). Your guarantor may even become involved in serving to arrange reimbursement plans in order that each events keep on monitor.

Ultimate ideas

Beginning out in life is a problem for a lot of younger individuals. In the event you’re fortunate sufficient to have members of the family (or excellent buddies or companions) with a superb credit score historical past, you might be able to use them as guarantors to your private mortgage. In the event you default on funds, then your lender can pursue authorized motion towards each your self and your guarantor. Because of this we wish to make as certain as doable you possibly can afford the mortgage from the outset. This contains any potential monetary shocks. We hope it’s going to by no means be the case that your lender has to take any type of motion towards you or your guarantor.

We hope this helps.

[ad_2]